does new mexico tax pensions and social security

The term parental leave may include maternity paternity and adoption leave. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance.

New Mexico Retirement Tax Friendliness Smartasset

Carbon taxes are intended to make visible the hidden social costs of carbon emissions which are otherwise felt only in indirect ways like more severe weather events.

. A carbon tax is a tax levied on the carbon emissions required to produce goods and services. The SSA does not include IRAs pensions interests annuities or dividends as part of your earnings. STATES SUMMARY OF STATUTES.

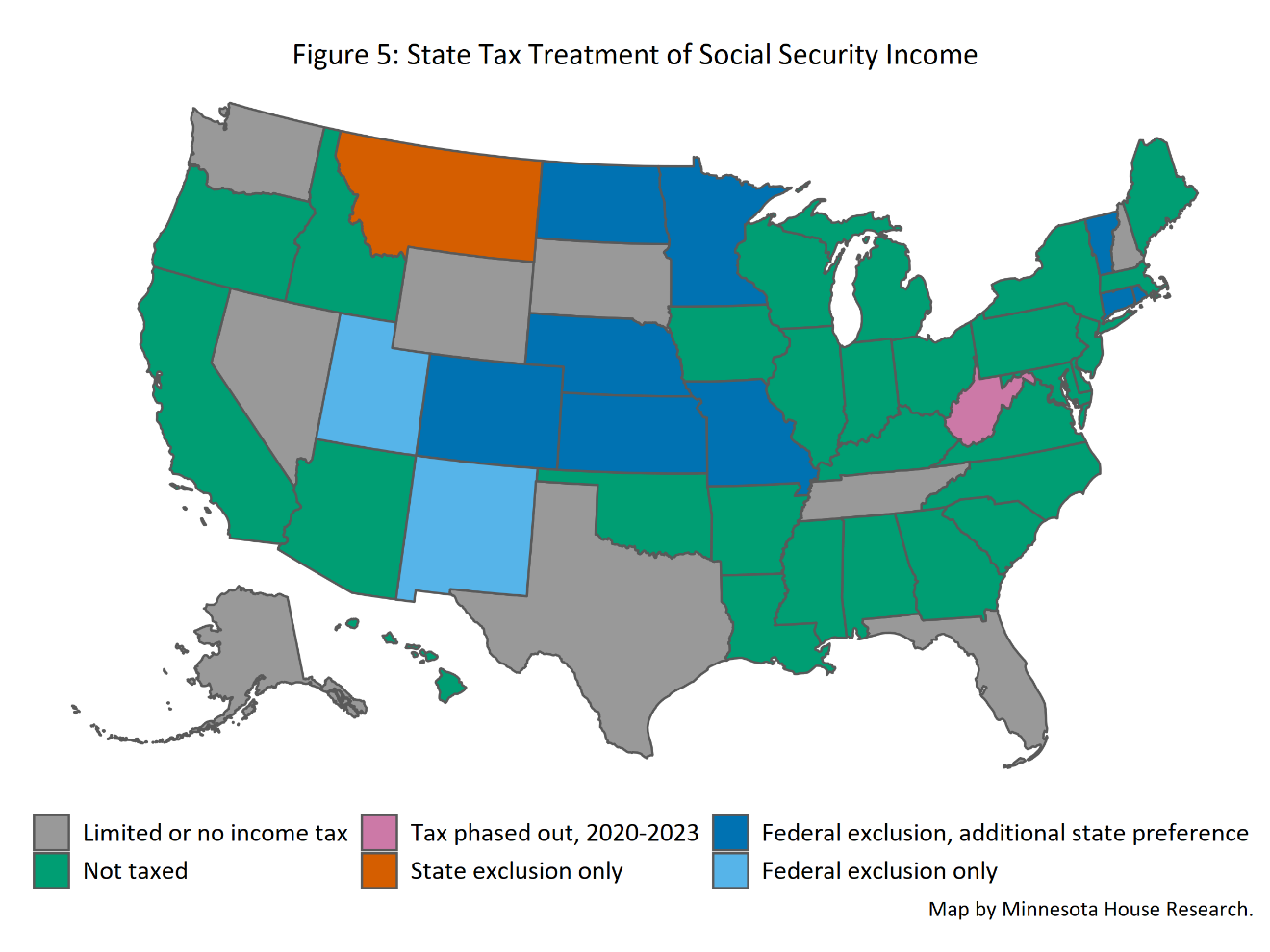

Code 22-1-13 2006 allows a mother to breastfeed her child in any public or private location. Tax revenues in Africa represent an increasing share of GDP during the last decade 2012 Figure 51. New Mexico taxes Social Security benefits pensions and retirement accounts.

Does investors political ideology shape international capital allocation. If I take money out of my IRA will it affect my Social Security benefit. As of 1st January 2022 according to the new regulations introduced by the Polish Deal the amount of 775 of the health insurance assessment base is no longer tax deductible for taxpayers reconciling their income.

Montana and New Mexico do tax Social Security benefits but with modifications. Taxpayers 65 years of age or older may be eligible for an income tax. Military pensions are tax-exempt in Minnesota.

In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration SSA. 2925080 and 0110060 1998 prohibit a municipality from enacting an ordinance that prohibits or restricts a woman breastfeeding a child in a public or private location where the woman and. To be eligible for the credit taxpayers must include valid identification numbers eg Social Security numbers on their tax returns.

If the attendant also provides personal and household services you can include as a medical expense only the amount of employment taxes paid for medical services as explained earlier. For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would reduce your liability. Get the latest international news and world events from Asia Europe the Middle East and more.

Public protests civil violence and food price indices 2012 Figure 52. The Department of Housing and Urban Development HUD sets income limits that determine eligibility for assisted housing programs including the Public Housing Section 8 project-based Section 8 Housing Choice Voucher Section 202 housing for the elderly and Section 811 housing for persons with disabilities programs. Some of the best states for retirees who want to avoid high taxes.

Ideological alignment on both economic and. Watch CNN streaming channels featuring Anderson Cooper classic Larry King interviews and feature shows covering travel culture and global news. In some countries and jurisdictions family leave also.

Taxpayers with a military pension and federal adjusted gross income of 37500 or less can claim a credit of up to 750. The social security shares payable by the employer and the employee are tax-deductible items in their respective PIT settlements. Life expectancy is a statistical measure of the average time an organism is expected to live based on the year of its birth current age and other demographic factors like sex.

Social security may either be synonymous with welfare or refer specifically to social insurance programs which provide support only to those who have previously contributed eg. Parental leave or family leave is an employee benefit available in almost all countries. We provide evidence from two settingssyndicated corporate loans and equity mutual fundsto show ideological alignment with foreign governments affects the cross-border capital allocation by US.

The most tax-friendly states for retirees are states that dont tax pensions and Social Security and have a low tax-profile overall for sales and property tax. Political Hardening Index 1996-2011 base year 1996 100. Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe.

Your Social Security benefit is not reduced by your military benefits. Dont include any social security benefits unless a you are married filing a separate return and you lived with your spouse at any time during 2021 or b one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than 25000 32000 if married filing jointly. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

Welfare or commonly social welfare is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Most pension systems as. A 500 credit is allowed for each qualifying child of the taxpayer.

How to Contact the Social Security Administration. News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage.

You can receive full benefits from both. 116th Congress Public Law 136 From the US. The most commonly used measure is life expectancy at birth LEB which can be defined in two waysCohort LEB is the mean length of life of a birth cohort all individuals born in a given year.

Dont include any social security benefits unless a you are married filing a separate return and you lived with your spouse at any time in 2021 or b one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than 25000 32000 if married filing jointly. The credit is eliminated for taxpayers with adjusted gross incomes exceeding 75000 150000 for joint returns. In this way they are designed to reduce carbon dioxide CO 2 emissions by increasing prices of the fossil fuels.

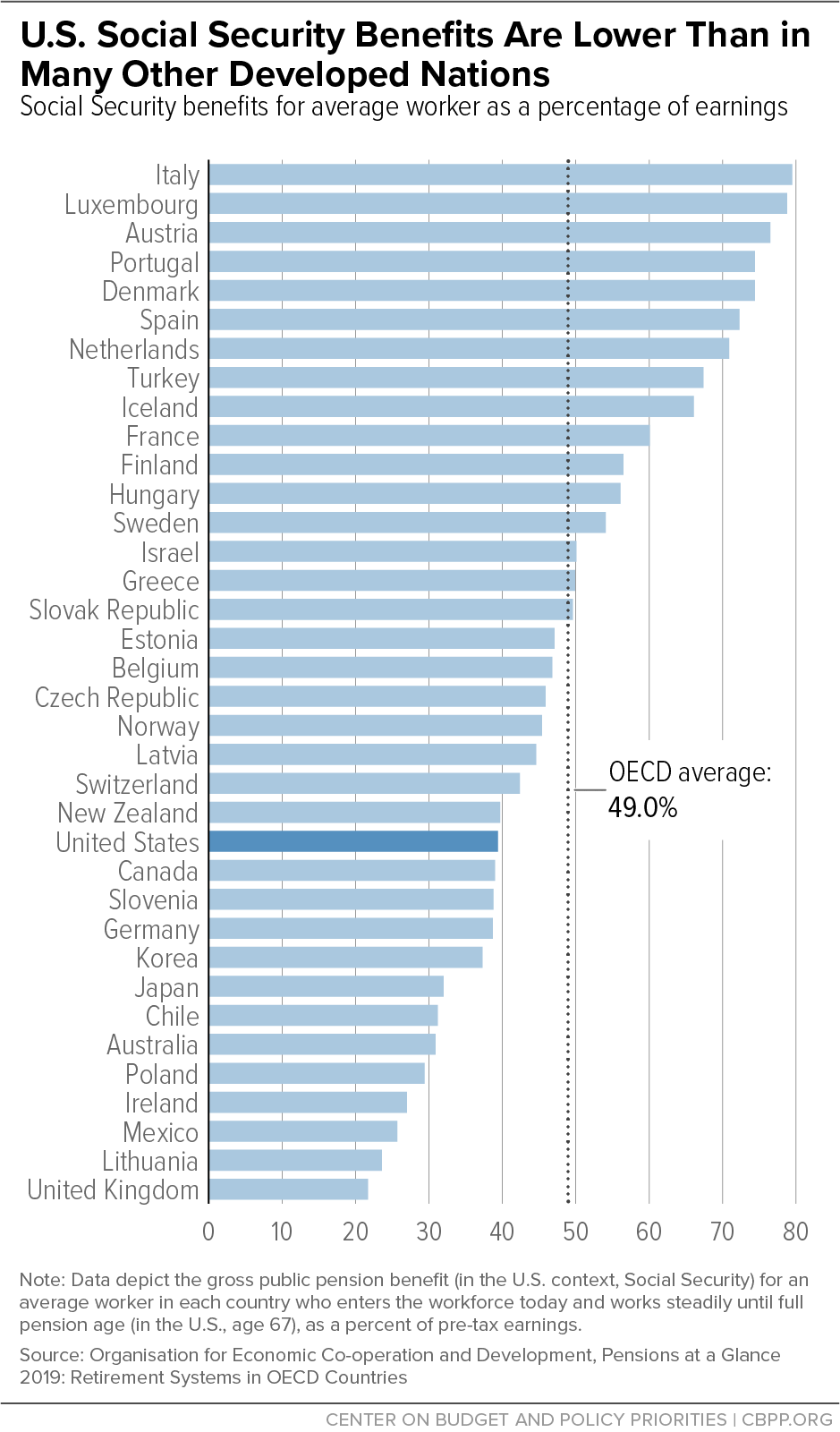

You can include as a medical expense social security tax FUTA Medicare tax and state employment taxes you pay for an attendant who provides medical care. Working with over 100 countries the OECD is a global policy forum that promotes policies to improve the economic and social well-being of people around the world. If a or b applies see the.

Or may be used distinctively from maternity leave and paternity leave to describe separate family leave available to either parent to care for small children. Government Publishing Office Page 134 STAT.

Tax Withholding For Pensions And Social Security Sensible Money

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

How Taxes Can Affect Your Social Security Benefits Vanguard

The States That Won T Tax Your Fed Retirement Income

Maximize Social Security Benefits In New York

Tax Withholding For Pensions And Social Security Sensible Money

Retirement Security Think New Mexico

Seniors Can Make This Much Retirement Money Without Paying Taxes

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha

Retirement Security Think New Mexico

Taxation Of Social Security Benefits Mn House Research

Social Security Income Tax Exemption Taxation And Revenue New Mexico

37 States That Don T Tax Social Security Benefits

New Mexico Retirement Tax Friendliness Smartasset

Your New Mexico Income Taxes Can Be Efiled Here At Efile Com

At What Age Is Social Security No Longer Taxed In The Us As Usa